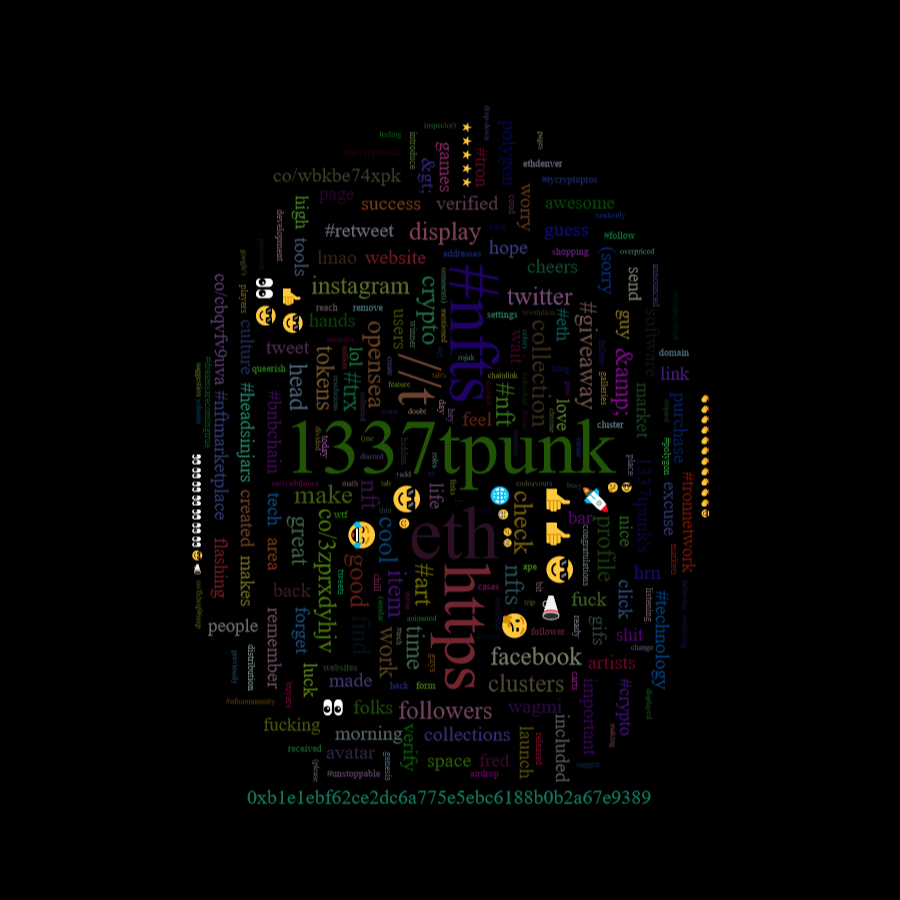

1337Tpunk List on CoinMarketCap

Algorand

$0.21

ARK

$0.32

Avalanche

$18.73

Binance Coin

$561.24

Biswap

$0.03

Bitcoin

$82,822.59

Bitgert

$0.0000

NOW Token

$0.25

DigiByte

$0.0099

Dogecoin

$0.17

Ethereum

$2,051.54

Klever

$0.0031

Lisk

$0.56

Litecoin

$97.14

Polygon

$0.23

Monero

$216.06

NEM

$0.02

Ravencoin

$0.01

Shiba Inu

$0.0000

Stacks

$0.64

Stellar

$0.27

TRON

$0.24

ZCash

$30.17

Zilliqa

$0.01

Algorand

$0.21

ARK

$0.32

Avalanche

$18.73

Binance Coin

$561.24

Biswap

$0.03

Bitcoin

$82,822.59

Bitgert

$0.0000

NOW Token

$0.25

DigiByte

$0.0099

Dogecoin

$0.17

Ethereum

$2,051.54

Klever

$0.0031

Lisk

$0.56

Litecoin

$97.14

Polygon

$0.23

Monero

$216.06

NEM

$0.02

Ravencoin

$0.01

Shiba Inu

$0.0000

Stacks

$0.64

Stellar

$0.27

TRON

$0.24

ZCash

$30.17

Zilliqa

$0.01

1337 Crypto To Hold Long Term

In the dynamic world of cryptocurrency, identifying assets with long-term potential is both an art and a science. This information delves into some cryptocurrencies, each with unique attributes that could make them viable for long-term holding. From established giants to promising newcomers, these coins span various sectors including DeFi, gaming, and smart contracts. Our aim is to provide a comprehensive overview, highlighting why each might be worth considering for your investment portfolio. Whether you’re a seasoned investor or new to the crypto space, let’s explore these digital assets that could shape the future financial landscape.

Algorand ($ALGO)

Algorand is known for its pure proof-of-stake consensus mechanism, offering speed, security, and scalability. Designed for the future of finance, ALGO supports atomic swaps and smart contracts, making it ideal for DeFi applications. Its governance model rewards participants, fostering an inclusive ecosystem. Long-term, Algorand’s focus on sustainability and zero transaction fees could make it a staple in blockchain solutions for both enterprise and individual use.

ARK ($ARK)

ARK’s vision is to simplify blockchain technology for mass adoption through its SmartBridge technology, allowing interoperability between blockchains. ARK offers a user-friendly platform where developers can create or deploy their own chains. With a strong community and a focus on user experience, ARK aims to bridge the gap between traditional finance and blockchain, potentially securing its spot as a long-term investment.

Avalanche ($AVAX)

Avalanche stands out with its high throughput and low latency, positioning it as a direct competitor to Ethereum in terms of smart contract functionality. Its innovative consensus protocol allows for sub-second finality, making it suitable for DeFi, gaming, and enterprise blockchain solutions. With a growing ecosystem and partnerships, AVAX holders might benefit from the network’s scalability and its potential to attract more dApps.

Binance Coin ($BNB)

As the native token of the Binance ecosystem, BNB has evolved from a simple fee discount token to a cornerstone of one of the largest crypto exchanges. It powers Binance Smart Chain, which hosts numerous DeFi projects. The coin’s utility extends across trading, payment for fees, and governance. With Binance’s continuous expansion, BNB could be a solid long-term hold due to its integral role in the ever-growing Binance platform.

Biswap ($BSW)

Biswap operates on the Binance Smart Chain, offering a decentralized exchange with high liquidity and low fees. BSW, its native token, provides holders with benefits like reduced trading fees and staking rewards. With a focus on user experience and community, Biswap aims to capture a significant portion of the DeFi market, making BSW an interesting option for long-term growth within the burgeoning DeFi sector.

Bitcoin ($BTC)

Bitcoin, the pioneer of cryptocurrencies, remains the gold standard in digital assets. Its decentralized nature, capped supply, and growing institutional adoption make it a compelling long-term investment. Often dubbed ‘digital gold’, Bitcoin’s use as a store of value has been validated over time. Despite its volatility, its foundational role in the crypto market ensures its relevance and potential for significant value increase over decades.

Bitgert ($BRISE)

Bitgert aims at being a blockchain with zero gas fees, high transaction speeds, and robust security. BRISE, its coin, has attracted attention due to its ambitious goals in the DeFi space. With plans for NFTs, gaming, and more, Bitgert’s ecosystem could grow significantly if it achieves its technical promises, making BRISE a speculative but potentially rewarding long-term investment.

NOW Token ($NOW)

NOW Token is part of the ChangeNOW ecosystem, focusing on instant crypto swaps. With no registration required, it prioritizes user privacy and simplicity. The token enables fee discounts and is used for governance. As crypto adoption increases, platforms like ChangeNOW could see more demand, potentially making NOW a useful long-term asset within the exchange and trading sector.

DigiByte ($DGB)

DigiByte aims for a secure, fast, and scalable blockchain with multiple mining algorithms to prevent centralization. It supports smart contracts through DigiAssets, expanding its utility. With a strong community and a focus on security, DGB could grow as blockchain technology finds more applications in daily life, offering a solid case for long-term holding.

Dogecoin ($DOGE)

Originally created as a meme coin, Dogecoin has evolved into a widely recognized cryptocurrency, partly due to endorsements from high-profile figures. Its unlimited supply and community-driven nature make it unique. While not always seen as a serious investment, Dogecoin’s integration into payment systems and its cultural impact could ensure its longevity, making it an interesting speculative hold.

Ethereum ($ETH)

Ethereum is the backbone of DeFi, NFTs, and smart contracts, fundamentally changing how we interact with digital assets. With the transition to Ethereum 2.0, aiming for proof-of-stake for better scalability and energy efficiency, ETH’s long-term value is supported by its dominant position in blockchain innovation. Ethereum’s continuous upgrades and developer support position it as a must-have for any long-term crypto portfolio.

Klever ($KLV)

Klever offers a user-friendly wallet with integrated financial services, backed by the KLV token which provides benefits like fee reduction and staking rewards. As crypto becomes more mainstream, tools like Klever that simplify user interaction with blockchain technology might see increased demand, potentially driving KLV’s value over time.

Lisk ($LSK)

Lisk’s goal is to make blockchain development accessible by enabling developers to write apps in JavaScript. With sidechains, Lisk allows for scalable solutions without congesting the main chain. If Lisk can capitalize on the demand for easy-to-use blockchain development tools, LSK could grow as part of the developer-friendly blockchain ecosystem.

Litecoin ($LTC)

Often called the silver to Bitcoin’s gold, Litecoin provides faster transaction times and a different hashing algorithm. Its role as a testing ground for Bitcoin improvements and its established market position make it a reliable option for those looking for stability and potential growth in a cryptocurrency that’s been around since the early days of digital currency.

Polygon ($MATIC)

Polygon is designed to solve Ethereum’s scalability issues, offering a framework for building and connecting Ethereum-compatible blockchain networks. With lower transaction costs and faster confirmations, MATIC has become vital for scaling Ethereum’s dApps. As Ethereum’s ecosystem grows, so too does Polygon’s relevance, making MATIC a promising long-term investment.

Monero ($XMR)

Monero focuses on privacy with transactions that are inherently private and untraceable. In an era where privacy concerns are escalating, Monero’s technology could gain more traction. Its strong stance on privacy might appeal to users seeking anonymity, potentially increasing its demand over time, despite regulatory challenges.

NEM ($XEM)

NEM introduced the concept of a “smart asset” blockchain, allowing for the creation of mosaics (tokens) and namespaces. Its unique Proof-of-Importance consensus mechanism rewards active network participants. If NEM can expand its use cases and partnerships, especially in areas like supply chain, XEM could see significant long-term growth.

Ravencoin ($RVN)

Ravencoin is tailored for asset creation, transfer, and management with a focus on mining decentralization. It’s well-received in the gaming and collectibles sectors due to its asset issuance capabilities. As blockchain finds more applications in asset tracking and tokenization, RVN could gain from this trend, making it a speculative but potentially rewarding long-term hold.

Shiba Inu ($SHIB)

Shiba Inu, a Dogecoin-inspired token, has made waves with its community and meme culture. With projects like Shibaswap, it’s venturing into DeFi. While its utility is debated, its community’s passion and plans for ecosystem development might give SHIB unexpected longevity, turning it into a cultural phenomenon with potential economic value.

Stacks ($STX)

Stacks aims to enable smart contracts and dApps on Bitcoin, leveraging Bitcoin’s security while expanding its functionality. With a mission to make Bitcoin programmable, STX could play a pivotal role if Bitcoin’s ecosystem expands. The potential for Bitcoin to become a platform for smart contracts could significantly boost STX’s value over time.

Stellar ($XLM)

Stellar’s mission is to facilitate low-cost, cross-border payments. Its partnership with IBM and focus on financial inclusion make it a player in the remittance market. If Stellar can scale its adoption among banks and financial institutions, XLM could become a cornerstone in global finance, providing a strong case for long-term investment.

TRON ($TRX)

TRON aims to decentralize the internet through content sharing and entertainment. With a focus on speed and scalability, TRX powers a growing ecosystem of dApps. If TRON can capture a significant share of the digital content and entertainment market, TRX might see substantial growth, making it a speculative long-term hold.

ZCash ($ZEC)

ZCash offers optional privacy through its zero-knowledge proofs, allowing shielded transactions. Its technology could become more valuable as privacy becomes a bigger concern in digital transactions. If privacy coins gain mainstream acceptance, ZEC might carve out a significant niche, offering both utility and speculative value for investors.

Zilliqa ($ZIL)

Zilliqa tackles blockchain scalability through sharding, aiming for high transaction rates. Its focus on practical blockchain applications like secure data solutions and smart contracts makes ZIL an intriguing option. If Zilliqa’s technology proves pivotal in scaling blockchain for mass adoption, ZIL could see considerable long-term growth.

Conclusion

This journey through these cryptocurrencies illuminates a diverse landscape where technology meets finance. From Bitcoin’s pioneering path to the niche roles of privacy-focused coins like Monero, each asset offers unique propositions. The key to long-term investment in crypto lies in understanding the technology, the team behind each project, and the potential for real-world application. Diversification across these assets could mitigate risk while potentially capitalizing on the growth of blockchain technology. Remember, the crypto market is volatile; thus, thorough research and a long-term perspective are crucial for anyone looking to invest in these digital currencies. Whether for speculation, investment, or belief in the technology, these coins represent the forefront of a financial revolution that’s still unfolding.